Novak developed his own trend bands but Keltner Channel bands also work quite well. Again the equity would backtrack to put in another A before the up trend resumed. After putting in an extreme pivot point outside the trend bands, the price would then backtrack a little and put in a pivot that he labeled “A.” Often, the price would then resume the original up trend to put in another extreme pivot outside the bands. This type of action was often a signal that a new short-term trend was being established. Confluence zones not shown.Īt the beginning of an up trend, for example, the equity would make an aggressive move to an extreme pivot point (marked “Ext” in Figure 2) outside its trend channel. John called it the ABC pattern, which he defines in simple terms: “It’s a stop run of the first pullback after an aggressive move to the upside that signifies more potential in the direction of the larger move.”įigure 2: An ABC pattern A pivot long signal. The greater the number of lines appearing on the chart, the more significant the level is.Īfter spending literally thousands of hours observing equity movements, especially at confluence levels, the Novaks began to notice a regular price configuration.

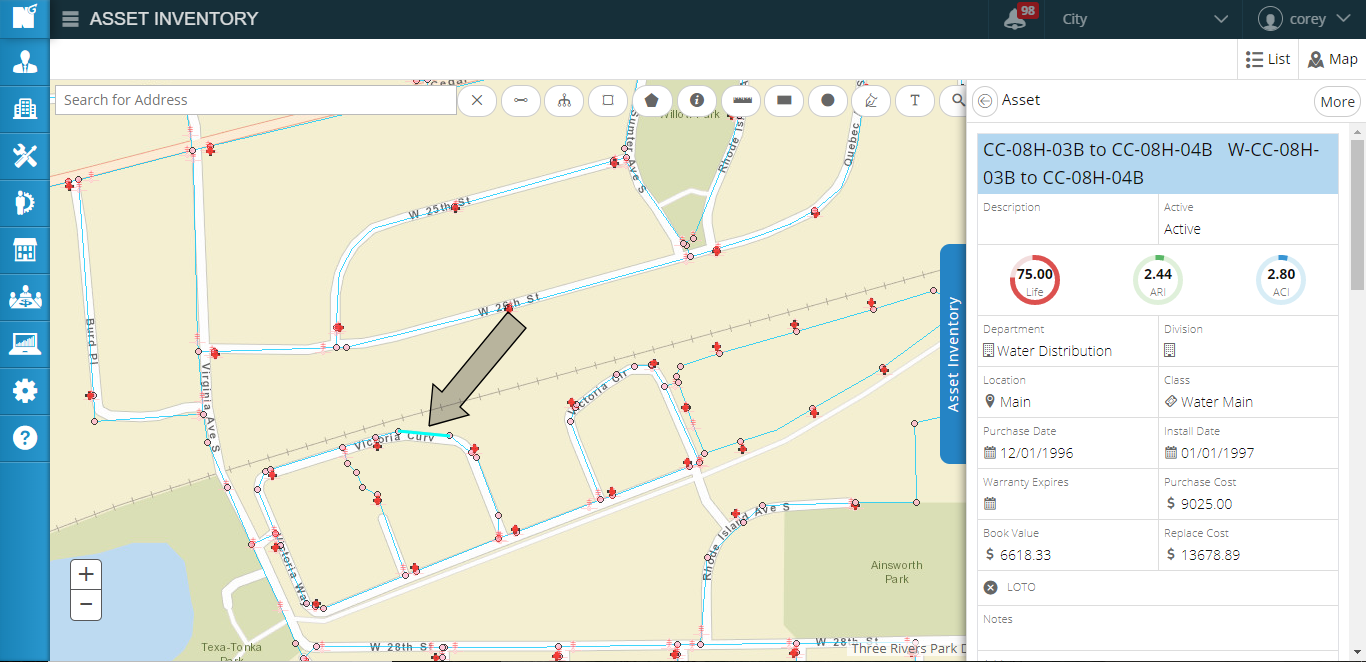

Signal provided by Nexgen Software Systems.įigure 1: Intraday chart of the S&P 500 e-minis (ES) showing computer T-3 Fibs Protrader generated confluence levels. These confluence levels allowed traders to see where a stock, future, commodity, or currency had the greatest probability of pausing or reversing on intraday charts.Ĭhart provided by. It was the program they called the T-3 Fibs Accumulator that automatically identified and plotted significant Fibonacci levels using 40 different time frames and major pivot points from each (see Figure 1). More than four years and a number of different program versions later, they finalized the solution. It was a major challenge that he and business partner (and wife) Melinda of Nexgen Software Systems sought to overcome. John Novak made it a personal goal to solve this problem and to see how effective Fib levels could be in trading. By the time either of these types of traders have drawn Fibonacci levels for each pivot point in each time frame, both often have a real mess on their hands.

The end-of-day trader may also use 60- and 90-minute time frames as well as daily and weekly data. Secondly, the intraday trader often uses more than one time frame-such as a one-minute, three-minute, five-minute, 10-minute and 30-minute chart-in making trading decisions.

0 kommentar(er)

0 kommentar(er)